I have always been fascinated by novel “medical tests” that can forecast things about my distant and future health prospects that are currently hidden from the naked eye, many years before any visible symptoms emerge. I personally have taken a fair share of these assessments especially as I continue to age (chronologically) thru the human lifecycle. In the language of probability theory, and pardon my geek Greek, I prefer having the largest possible sigma field of information about my stochastic…

Author: Moshe Milevsky

Longevity: Credits Beat Insurance

I’m stumbling into a growing cloud of confusion, one that’s creeping into the dialogue around life annuities and insurance products with guaranteed lifetime income. This fog is pervasive and thick within the neighborhood of rationales and reasons offered to retirees as to why they might want to include annuities in their aging portfolios. Generally speaking these well-intentioned conversations center around the longevity risk that is associated with living an unexpectedly long time, or the financial cost of becoming a centenarian…

Australian Retirement vs. Decumulation

Australians retire with millions of dollars. It’s not that Australia is necessarily wealthier than any other country, although they certainly rank high on a per capita basis. Rather, they happen to reach retirement age with millions of dollars in their retirement savings accounts. The source of (and credit for) their wealth is the Australian government who forces workers to save close to 10% of their salary in an investment account, and it’s employers mostly who contributing to that pot. To…

History of Annuity Haters

A few years ago, while I was rummaging around the National Archives in London (UK), doing research for a book I was writing on tontine schemes, I came across a rather remarkable (although unrelated) document written over two centuries ago. It was a pamphlet consisting of approximately 25 pages, the first of which is shown and reproduced down here on the left. The author of this pamphlet was anonymous and simply signed his name on the publication date of June…

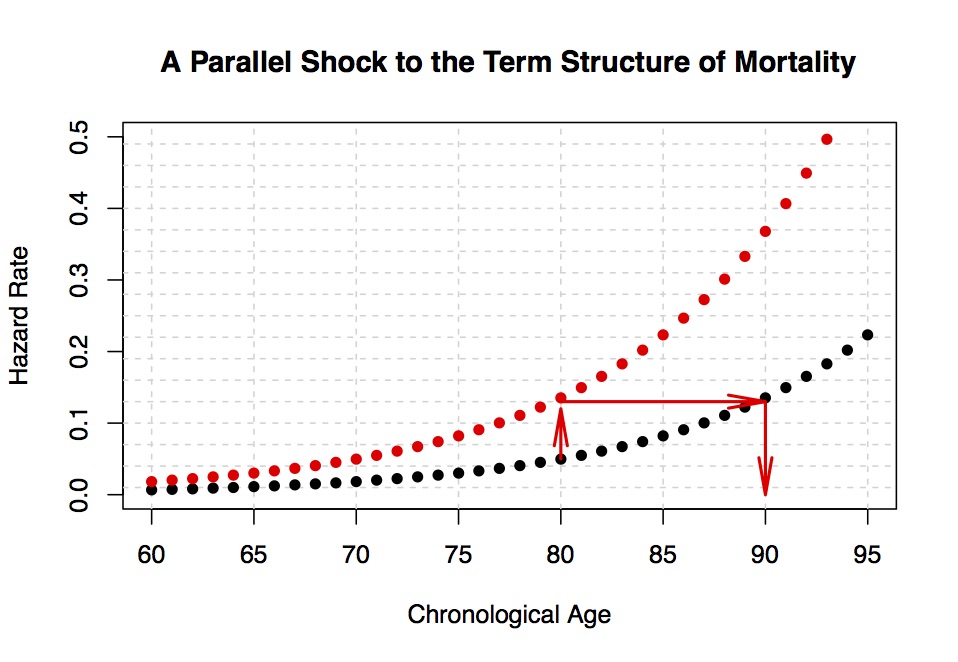

Covid-19, Longevity Risk & the Economics of Annuitization

Although the dire medical situation and mounting economic toll of covid-19 is of immediate and first-order importance, the virus has also prompted many to ponder their own mortality. Whether it’s doctors in emergency rooms who quickly redrafted codicils or nursing home attendants pondering their own DNR instructions, the randomness or mortality is being imprinted on our susceptible behavioral minds. Interestingly, preliminary and anecdotal evidence suggests a spike in the acquisition of life insurance policies over the last few months, perhaps…

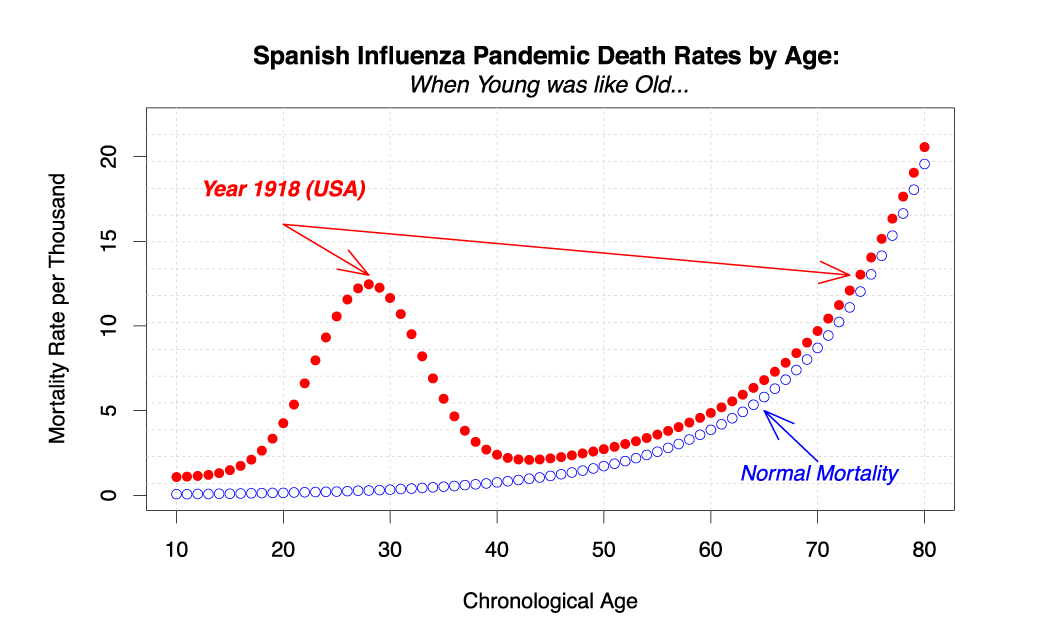

Insurance Lessons from the Spanish Flu

Slightly over a century ago, in January 1918, doctors at a military camp in Haskell County, Kansas, USA, were puzzled by cases of local soldiers with severe flu symptoms. In the most extreme cases the signs of severe illness included hemorrhaging (i.e. massive bleeding) from the nose, ears and stomach. A painful and rapid death followed the symptoms with a very high probability, with the official cause of death being pneumonia or massive hemorrhaging itself. At first – what much…